Spotify Q2 2025 Earnings Report Second-Highest Q2 Monthly Active Users (MAUs) Growth in History

With Spotify Q2 2025 Earnings, the Online Streaming Platform Delivers Another Strong Quarter; Premium Subscribers and Profitability Continue Upward Trend

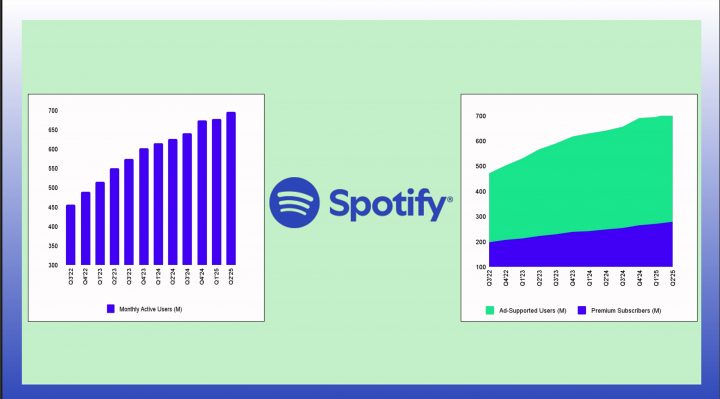

Spotify Q2 2025 earnings report highlighting accelerating growth in subscriber and Monthly Active Users (MAUs), alongside continued improvements in profitability. In the first half of 2025, subscriber net additions grew more than 30% compared to the first half of 2024, and this marks the company’s second highest Q2 for MAU net additions.

Notable highlights from the Q2 report include:

● Premium Subscribers grew 12% Y/Y to 276 million, driven by strong performance in both mature and emerging markets.

● Monthly Active Users (MAUs) rose to 696 million with adding 18 million which is the second highest Q2 MAU net adds in history.

● Total Revenue grew to €4.2 billion, reflecting a solid 10% Y/Y growth.

● Gross Margin in line with guidance and reached basis points 31.5%.

● Operating Income reached €406 million, underlining the strength of Spotify’s operating model and sustained cost discipline.

Expressing his sentiments, Daniel Ek, Spotify’s Founder and CEO, said, “People come to Spotify and they stay on Spotify. By constantly evolving, we create more and more value for the almost 700 million people using our platform. This value not only benefits users but it’s attracting more people to streaming and as a result, it’s also boosted the industries of music, podcasts, and audiobooks.”

Scaling audiobooks through market expansion and add-on subscriptions

Rolled out Audiobooks in Premium to 4 new markets (Germany, Austria, Switzerland and Liechtenstein), giving users flexible ways to pay for access to over 350,000 titles through eligible Premium subscriptions.

Launched two new add-on Audiobooks subscriptions: Audiobooks+ unlocks 15 extra hours of listening per month for individual subscribers and plan managers, while Audiobooks+ for Plan Members extends the same benefit to additional Family and Duo members through a recurring add-on.

Audiobooks in Premium have grown rapidly since launching in 2023, with listening hours up more than 35% Y/Y in the U.S., U.K. and Australia.

As compare to Spotify Q2 2025 earnings, it’s Q3 2025 outlook projects continued momentum across key performance metrics. The company anticipates Total Monthly Active Users (MAUs) reaching 710 million, suggesting the addition of approximately 14 million net new users during the quarter. Similarly, Total Premium Subscribers are expected to climb to 281 million, with an increase of around 5 million new subscribers. Total Revenue is forecasted to remain at €4.2 billion.

The Gross Margin is estimated at 31.1%, incorporating a regulatory charge in the Premium segment. Operating Income is projected to rise to €485 million, which includes a €25 million social charge based on Spotify’s Q2 closing share price of $767.34.

These projections reflect Spotify’s confidence in maintaining growth and profitability while managing global market variables. However, the company emphasizes that these forward-looking statements are subject to substantial uncertainty and may be influenced by evolving economic and regulatory factors.